Yesterday, a new study was published about Scandinavia, showing how an estimated “top 0.01% of the wealth distribution— a group that includes households with more than $40 million in net wealth—evades about 30% of its personal income and wealth taxes”.

The study, titled “Tax Evasion and Inequality”, was published by Annette Alstadsæter (Norwegian University of Life Sciences), Niels Johannesen (University of Copenhagen) and Gabriel Zucman (UC Berkeley and NBER).

Our new paper on tax evasion and inequality, using Swiss Leaks and Panama Papers, is live! https://t.co/6Ej7IEC5Gd pic.twitter.com/PE5LVqrs0W

— Gabriel Zucman (@gabriel_zucman) May 29, 2017

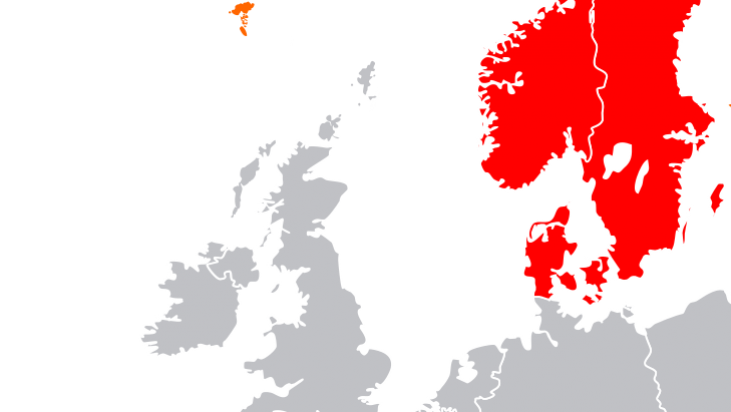

“This paper, the academics explain, attempts to estimate the size and distribution of tax evasion in rich countries. We combine stratified random audits—the key evasion so far—with new micro-data leaked from two large offshore financial institutions, HSBC Switzerland (“Swiss leaks”) and Mossack Fonseca (“Panama Papers”). We match these data to population-wide wealth records in Norway, Sweden, and Denmark. We find that tax evasion rises sharply with wealth, a phenomenon that random audits fail to capture.”

It received some great media attention since yesterday, and was on the front page of one of the largest newspapers in Norway, Aftenposten, which interviewed Sigrid Klæboe Jacobsen, head of the Norwegian branch of the Tax Justice Network.

“The politicians have been awakened, she says. It’s wrong to assume Norwegian taxpayers are more ethical than others”. Sigrid Klæboe Jacobsen supports that the researchers have worked with leaked data, the newspaper adds. “The leaks have caused the politicians to wake up. The tax settlement in the Norwegian parliament last year agreed to look into the role of banks and other advisers in international tax planning. That’s good, she says”.