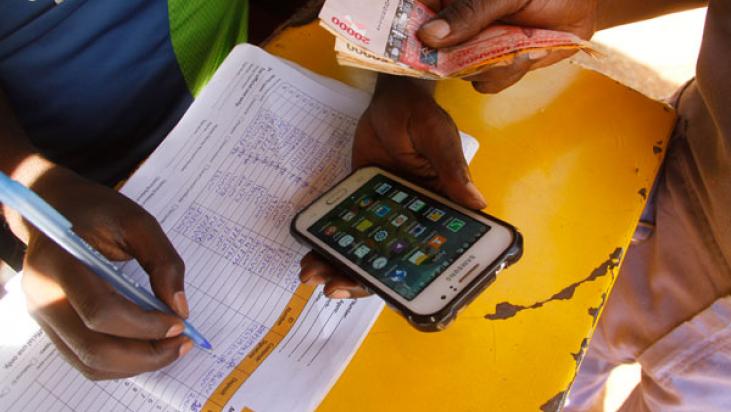

The Global Alliance for Tax Justice regional network, Tax Justice Network Africa´s member SEATINI Uganda together with other CSOs under the Tax Justice Alliance Uganda, developed a position paper on Mobile Money and Over the Top services taxes in response to the Ugandan government´s proposal to levy a 0.5% tax on all mobile money transactions and the daily excise duty amounting to UGX 200 over the top (OTT) services on social media.

Some of the concerns raised include:

- Stagnation of interet penetration

- Violation of the right to access to information

- Stiffle budding technology innovations

- Regressive nature of the proposed flat rate taxes

- Financial exclusion

- Increase unemployment

Uganda is facing enormous challenges regarding revenue mobilisation, allocation and utilisation including;

- Tax revenue forgone through tax exemptions: While the government expects to collect UGX 115bn and UGX 284bn from the taxes on Mobile Money and Over the Top services respectively, it is important to note that Uganda currently loses over UGX 90 billion to UGX 1 trillion annually due to tax exemptions that are awarded with the aim of attracting Foreign Direct Investment. This amounts to 4-5% of GDP annually.2 Furthermore, there is a growing class of rich and influential individuals who have been able to exempt themselves from paying tax. There also remains an untaxed section in Uganda as viewed from illegal mining of both sand, gold, marble and other minerals; commercial agriculture among others. This comprises High Net worth Individuals (HNWIs) the Uganda Revenue Authority has failed to track.

- Allocation of funds to critical sectors: It is also important to note that during the past years government has allocated a bigger share of the budget to infrastructure development. This year, the sector was allocated 19.08% of the total budget. On the other hand, productive sectors such as agriculture, trade, tourism received 3.56%, 0.53% and 0.13% of the budget respectively.

- Misappropriation of funds: There is a high rate of fiscal indiscipline characterised by a high rate of corruption. Furthermore, the government is increasingly relying on debt to for re-current expenditure which does not yield any returns to pay back the debt. As a result, the government has resorted to imposing taxes which are non- cognisant of the principles of fairness, certainty, convenience and efficiency.

It is upon the above premise that the CSOs demand that government;

- • Holds a debate on the state of the economy with the citizens

- • Repeals sections 3(b) and 6(g) of the Excise duty Act relating to the taxes on Mobile money and Over the Top Services in Uganda to achieve universal coverage of internet and further allows innovations and financial inclusion in Uganda.

- • Broadens the tax base in a fair and just way by scrapping all the harmful tax incentives, tapping into illegal mining and exporters of illegal minerals, commercial agriculture, the tracking HNWIs to bring everyone who should be paying tax to book.

- • Checks public administration expenditure particularly the oversize cabinet, bloated parliament, extensive network of presidential advisors and presidential assistants and a host of quasi-public service appointments such as RDCs that undermines cost- efficiency. Provides spaces for sustained engagement with citizens on how revenue is mobilised, allocated and utilised.

The alliance carried out a number of advocacy stunts inclduing media engagements through radio, television, press statement and twitter chat and organising two press conferences. The press conference organised brought on board the people that have been affected including mobile money dealers, a representative from people with disabilities since they receive money via mobile money. They also had an opportunity to present a Petition on the two contentious taxes to Parliament through the Leader of opposition.

The CSOs vow to continue carrying out advocacy activities to challenge this proposal.

More media articles can be found here! Daily monitor and New Vision