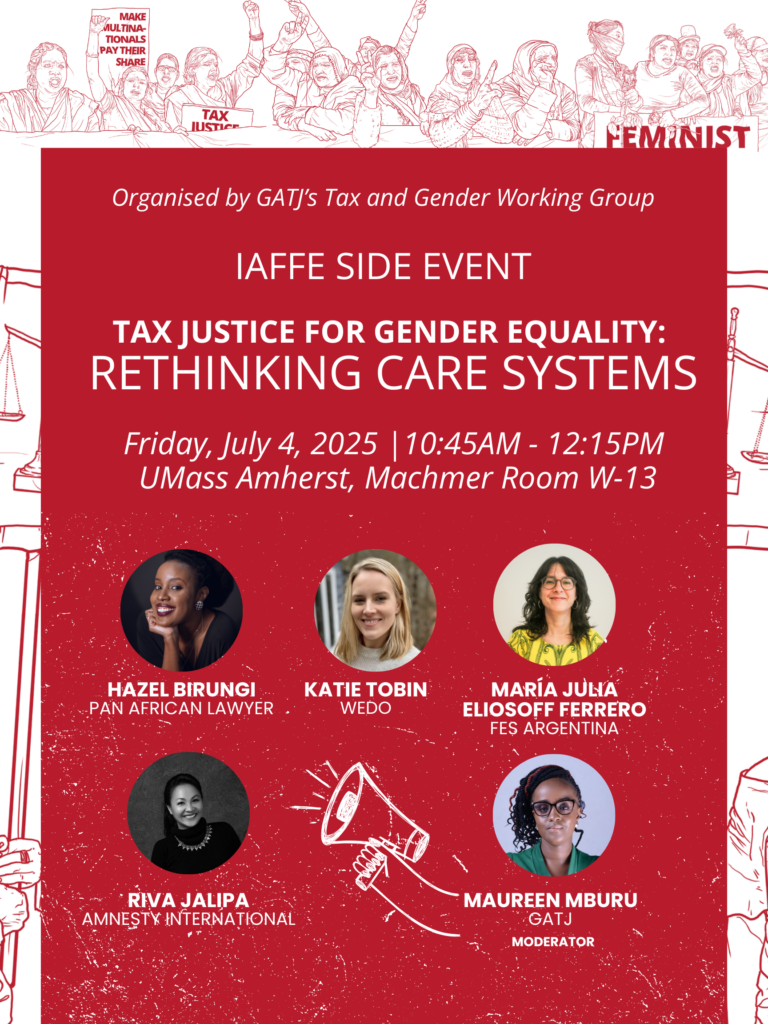

📅 Friday, 4 July

🕥 10:45am – 12:15pm

📍 IAFFE | UMass Amherst, Machmer Room W-13

Feminist economics increasingly recognizes the need for tax systems that address the gendered dimensions of care work, a key driver of gender inequality. Traditional public care policies have focused on women’s paid labor, through mechanisms like maternity leave and daycare, but often overlook informal and unpaid care work, particularly those engaged in by women outside the formal labor market or in self-employment. This exclusion underscores the necessity for universal care systems that are inclusive of all women, regardless of employment status, and adequately financed by fair and progressive tax policies.

This discussion builds on the Framing Feminist Taxation guide to explore the intersection of care, gender equality, and taxation. It advocates for tax systems that not only fund universal care but also redistribute unpaid labor and income, addressing long-standing gender disparities. These systems should prioritize care for children, the elderly, people with disabilities, and other dependents, while also ensuring fair compensation and support for care workers, including migrant laborers. The panel will use feminist taxation as a lens to examine how current tax policies—often inadequate or inequitable—fail to meet the diverse needs of women and marginalized groups.

The third volume of the Framing Feminist Taxation guide focuses on the challenges and alternative approaches for financing care through taxation. It includes case studies from diverse Global South regions—Africa, Latin America, and Asia—providing insights into how different countries structure their tax systems and care policies, and the gendered impact of these systems on women and marginalized communities. The case studies explore the scope of public care services, funding adequacy, the role of the private sector, and potential tax reforms (e.g., wealth or inheritance taxes) to generate additional revenue for care.

The interactive panel will highlight key insights and recommendations for reforming tax and fiscal policies to finance sustainable, equitable care systems. It will call for tax frameworks that support women’s rights and contribute to reducing inequalities both within and across societies. By drawing from the case studies, the session will offer practical lessons on how countries can build a comprehensive and inclusive social organisation of care that guarantee gender justice and foster long-term social protection.

#MakeTaxesWorkForWomen