Leer en español

Last week in Global Alliance for Tax Justice (GATJ)’s members: Initiatives to reform the global financial architecture have been the topic of discussions in Latin America and Europe. The fight against illicit financial flows continues to advance in Africa. Global North countries are called out by activists from Asia for not fulfilling development finance commitments. Inflation in Canada makes way to an excess profit tax recommendation. Check out all highlights:

Latin America

On 14 June, Latindadd released a statement about the New Global Financial Pact Summit and Bridgetown Initiative, two global financial reform proposals that have been in discussion by those working towards a new international financial architecture. The organisation classified both initiatives as “disappointing” and “far from expectations”, taking both governance and content into consideration.

“(…) both [initiatives] promote expanding Multilateral Development Banks (MDBs) participation through more lending, the catalyzation of private sector investments and blended finance, among other things, that reveal the intention of using the “climate emergency” as an excuse to deepen alternatives that Latindadd and other economic justice movements have been criticising for so long”, says their statement.

They also explained why they decided not to participate in the New Global Financial Summit, which will take place later this week on 22 and 23 June in Paris (France), under the auspices of the French government. Read the full analysis on that and on the Bridgetown Initiave in Latindadd’s website.

Red de Justicia Fiscal de América Latina y El Caribe (RJFALC), Latindadd and other organisations promoted a debate in Buenos Aires (Argentina) about the importance of promoting a feminist taxation system in the region. The discussion was live-streamed and the recording is available on Facebook.

📢 #Evento Los feminismos y la economía feminista cuentan con múltiples herramientas para aportar a la discusión fiscal.

¡Sumate a debatir sobre fiscalidad con referentes y expertas de la región!

Inscribite 👉 https://t.co/pP31bUPRfZ#FiscalidadFeminista #JusticiaFiscal pic.twitter.com/EfsfjqlxYY

— Red de Justicia Fiscal ALC (@justiciafiscal) June 12, 2023

Africa

The Tax Justice Network Africa (TJNA) shared a new step following the launch of the African Parliamentary Network on Illicit Financial Flows and Taxation (APNIFFT), coordinated by TJNA, on 19 May in Madagascar. Now, members of the Madagascar Parliament have their own national platform to advocate for legislative reforms that can help combat IFFs in the country. Learn more about APNIFFT and the process to get to this point on TJNA’s website.

Madagascar MPs vow to increase efforts in combatting illicit financial flows and championing legislative reforms to promote domestic resource mobilization in the country. #TaxJusticeAfrica #AfricaAgainstIFFs

Read more 👉https://t.co/9N36TEFqbu

Like, comment, share pic.twitter.com/PwS6yvj9eu

— Tax Justice Network Africa (@TaxJusticeAfric) June 14, 2023

Asia

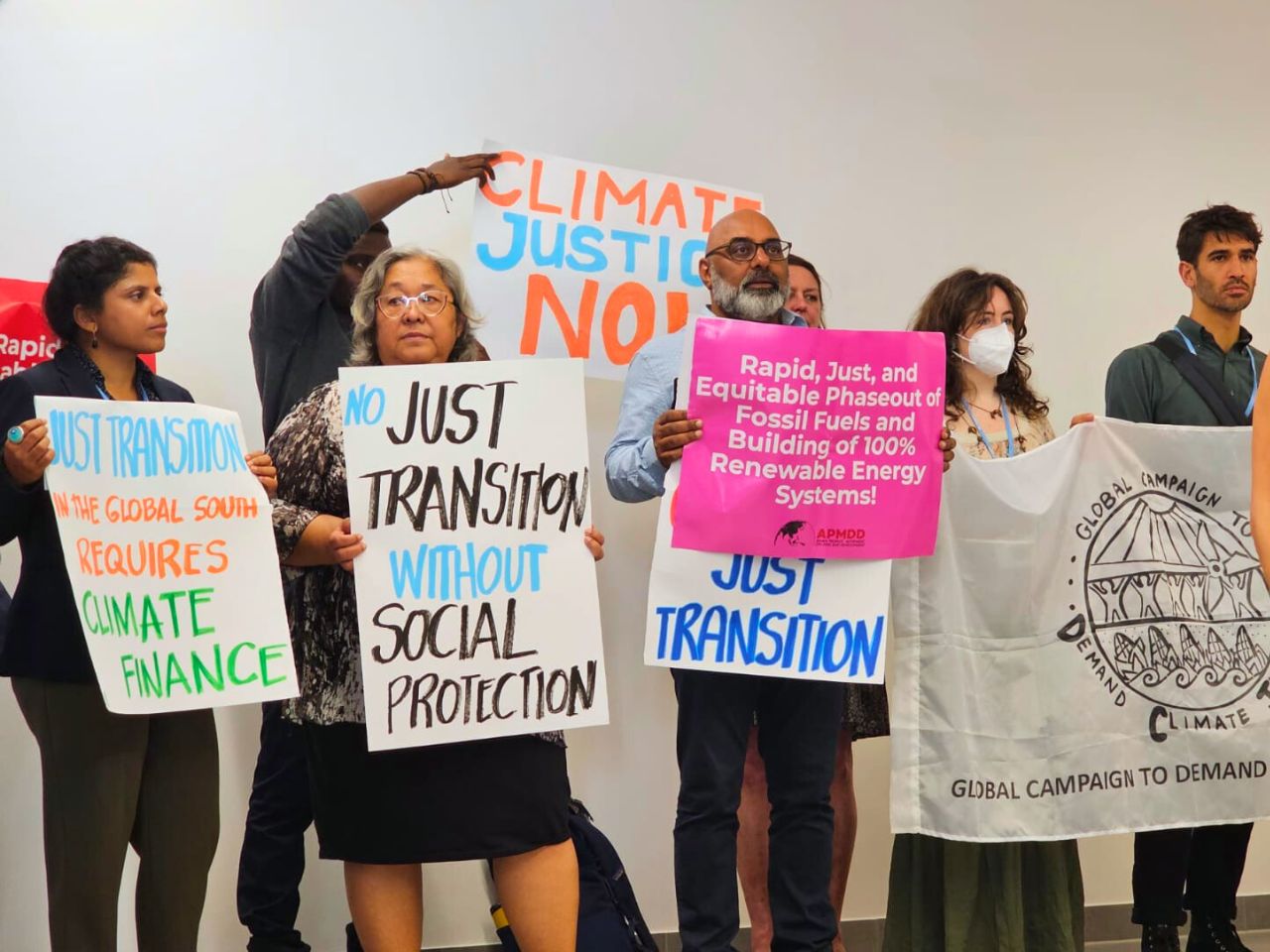

Members of the Asian Peoples’ Movement on Debt and Development (APMDD) have spoken in the United Nations’ Climate Change Conference in Bonn (Germany). Claire Miranda, climate justice advocate at APMDD, called out Global North countries on not fulfilling their climate finance obligations towards the Global South.

She criticised rich countries’ governments for talking big on just energetic transition, but not providing the financial and technological resources the Global South needs to fight climate change, while proposing loans and unsustainable finance solutions.

In the same conference, APMDD’s Lidy Nacpil talked about reparations for climate debt, highlighting that reparations is a crucial element for a just transition.

@GretaThunberg 👱🏼♀️even joined the #JustTransition action led by @gcdcj and joined CSOs in demanding #ClimateFinanceNow for the #JustTransition of the Global South! ✊🏽 pic.twitter.com/pWsmEQaBFj

— APMDD (@AsianPeoplesMvt) June 14, 2023

Europe

Eurodad had a two-day conference in Brussels (Belgium) to debate how civil society can challenge false solutions being presented to address urgent global crises involving tax, debt, aid, development finance and climate change. Tove Maria Ryding, tax justice policy and advocacy manager at Eurodad and member of GATJ’s coordination committee, moderated a panel about how organisations can help debunk the myth of the “financing gap”.

During the discussion, Jayati Ghosh, from the Independent Commission for the Reform of International Corporate Taxation (Icrict), pointed out that while almost everyone agrees that the global financial architecture should be reformed, there is no real action, only “endless pageantry”.

And #EurodadPF22 is underway!

Over the next two days we will debate and discuss how we, as #CivilSociety can challenge the false “solutions” being offered to the multiple crises of #Debt, #Climate, #Aid, #DevelopmentFinance & #Tax. pic.twitter.com/qgPYcXt7bA— Eurodad (@eurodad) June 13, 2023

North America

Canadians for Tax Fairness (C4TF) shared the Standing Committee on Finance report on food price inflation in Canada. The document references the organisation’s economist DT Cochrane testimony in the Committee, where he talked about the role of corporate profits in raising prices.

“Corporations are not just passing along higher costs. Many are taking advantage of turmoil throughout the global economy to boost profit margins,” stated Cochrane in the hearing.

The report mentions that the Canadian government “should consider introducing a windfall profits tax on large, price-setting corporations to disincentivize excess hikes in their profit margins”, which has been called for by C4TF for over a year.

Check out more details of their Twitter thread on the report:

The Standing Committee on Finance has released its report on food price inflation. Some highlights… (1/6) https://t.co/LNsKsnmyAc #cdnpoli

— Canadians for Tax Fairness (@FairTaxCanada) June 14, 2023

The Financial Accountability & Corporate Transparency (FACT) Coalition is inviting all anti-corruption advocates to join them in a beneficial ownership transparency policy discussion that will take place in the UNCAC Coalition virtual global conference later this month. The session featuring FACT will be on 29 June. Civil society representatives can participate by registering on UNCAC’s website.

🎙️Calling all anti-corruption advocates!🎙️

Join FACT, @OpenOwnership, @OCCRP, and @anticorruption for a discussion of beneficial ownership transparency policy as a part of @uncaccoalition's upcoming global conference ahead of #CoSP10! https://t.co/fFfZh5Cxxk

— FACT Coalition (@FACTCoalition) June 15, 2023

Photo: APMDD