Attendees of the XIV Regional Meeting with Tax Administrations on International Taxation.

The Start of the UN Tax Convention Negotiations

Following the start of the substantial negotiations for a UN Framework Convention on International Tax Cooperation (UN Tax Convention) in August, negotiations on the legally-binding convention and two early protocols will continue from November 10th to 19th at the UN in Nairobi, Kenya. GATJ continues to bring together civil society and trade unions to advocate as a united voice around the UN Tax Convention negotiations. Read more on the work of civil society in the UN Tax Convention negotiations here.

GATJ’s Members

Latin America and the Caribbean

Luis Moreno, Latindadd International Tax Director and GATJ Chair, speaking at the XIV Regional Meeting.

Red de Justicia Fiscal de América Latina y el Caribe (RJFALC) supported the XIV Regional Meeting with Tax Administrations on International Taxation in Bogota, Colombia from October 1st to 4th. The meeting took place with over 50 representatives from tax administrations along with tax experts and representatives from the United Nations and civil society. Speakers from RJFALC, GATJ, and TJNA participated in a roundtable on regional and international tax initiatives.

RJFALC, with the support of GATJ, released an analysis on the interests of the private sector in the UN Tax Convention negotiations.

Africa

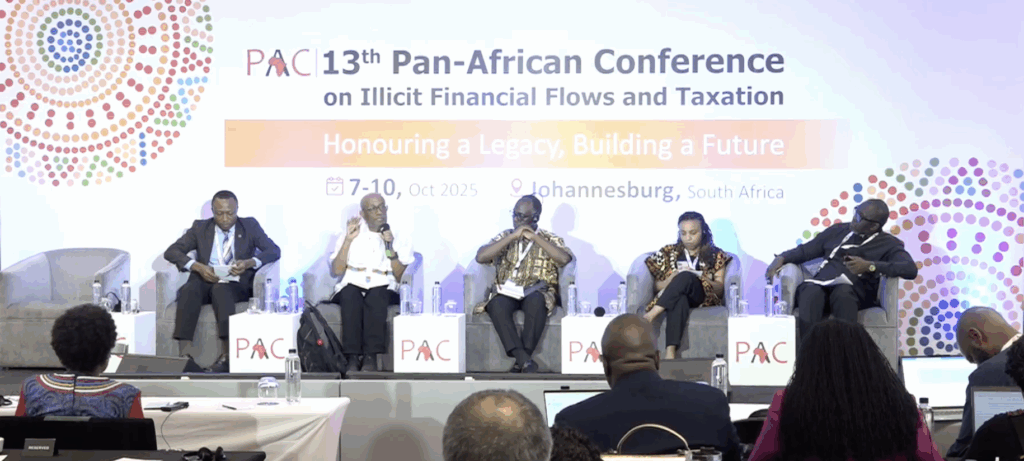

Dr. Dereje Alemayehu, GATJ Executive Coordinator, speaking at PAC.

Tax Justice Network Africa (TJNA) co-convened the 13th Pan-African Conference on Illicit Financial Flows and Taxation, from the 7th to 10th October in Johannesburg, South Africa. The event marked a decade since the release of the landmark 2015 High-Level Panel Report on Illicit Financial Flows, which revealed the staggering scale of illicit capital flight from Africa. In a session on Decolonizing the Global Tax Architecture, speakers from GATJ and TJNA highlighted the importance of the UN Tax Convention negotiations.

Following PAC, from October 13th to 15th, TJNA convened the African Parliamentary Network on Illicit Financial Flows and Taxation. GATJ moderated a panel on Incorporating a Gender Lens in Taxation emphasizing the importance of considering gender in tax policy, particularly for informal and care work.

Asia

Tax and Fiscal Justice Asia (TAFJA) members held a virtual roundtable discussion on the UN Tax Convention negotiations on October 10th. The event brought together TAFJA members to share civil society perspectives on the current negotiations and discuss work in the lead up to the next negotiation session in Nairobi.

Europe

Tax Justice Europe (TJ-E) held a meeting with members from September 29th to October 1st in Paris, France. The meeting included sessions on updates from members on national tax policies in Europe, discussions on taxation at the EU, and advocacy towards European countries in the UN Tax Convention negotiations.

North America

Canadians for Tax Fairness (C4TF) continues to spread the word about their most recent report on tax havens, exposing how wealthy Canadian corporations and individuals are stashing billions in foreign jurisdictions. C4TF also released their recommendations for the upcoming federal budget, which is set to be tabled by new Canadian Prime Minister, Mark Carney.

The Financial Accountability & Corporate Transparency (FACT) Coalition is launching a new report: “America-Last and Planet-Last – How US Tax Policy Subsidizes Oil and Gas Extraction Abroad.”