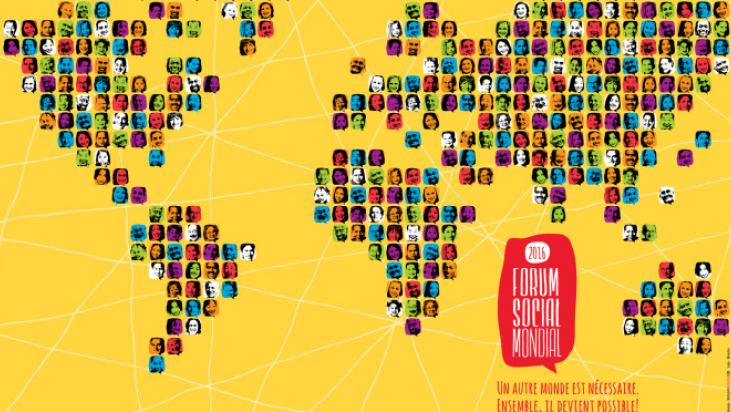

The following events have been registered for the World Social Forum, to be held in Montréal, Canada – August 9th to 14th

Presented by: Global Alliance for Tax Justice [Tax Justice Network–Africa, Red de Justicia Fiscal de América Latina y el Caribe, Asian Tax & Fiscal Justice Alliance, North America (Canadians for Tax Fairness/ Fact Coalition/TJN-USA), Tax Justice Europe],Oxfam, RightingFinance, Center for Economic and Social Rights, Egyptian Center for Economic and Social Rights, MiningWatch Canada, AWID, Eurodad, Tax Justice Network, ActionAid, Christian Aid, Public Services International, KEPA (Finnish NGO Platform), Global Progressive Forum, CNCD-11.11.11 & more partners.

- CAMPAIGN TRAINING: Tax Justice & the Extractive Industries

[tentatively scheduled for 10 August 2016)

Join Tax Justice & the Extractive Industries campaign trainings (offered in Spanish, French, English) bringing together people from south and north. Trainings will ideally be held all on one morning, followed by an afternoon forum with all three language groups to discuss common messaging, strategies and opportunities for joint action at national, regional and global levels.

- Tax Justice & Human Rights Forum

[tentatively scheduled for 11 August 2016)

Join discussion on how governments must apply equitable taxation policies to meet their obligations to deliver social and economic rights to everyone. Taxation is critical to finance for development and a powerful tool for stimulating poverty reduction – including sustainable investment in public services and infrastructure. Taxation is a key means for ensuring women’s equality.

- Tax Justice to Deliver Human Rights –Convergence Assembly/Assemblée de Convergence/ Asamblea de Convergencia

[tentatively scheduled for 12 August 2016)

Contribute creative ideas and strategies to advance the global campaign to make multinational corporations pay their fair share of tax, and to ensure our governments invest the funds in public services and the environment to end inequality and poverty. A “Tax Justice to Deliver Human Rights” communiqué will be deliberated and approved for international distribution at close of WSF.

- Women & Girls, Equality & Tax Justice • Les femmes, les filles, l’égalité et la justice fiscale • Las Mujeres, las Niñas, Equidad y Justicia Fiscal

[date to be announced]

Join this important discussion on how we can achieve gender justice along with tax justice. The growing misuse of tax cuts, combined with austerity and privatization measures, is undercutting women’s progress toward economic and social equality. The resulting drop in tax revenues is used to justify cutting vital public services, jobs, and sustainable development funds. Around the world, the tax burden is being shifted from progressive taxes on corporate income to regressive consumption taxes (VAT/TVA) paid by common people. Women, particularly poor and indigenous women, are paying the heaviest price for these misguided policies. Girls’ education in particular has suffered from the proliferation of privatized schools.

- The Price We Pay –film screening

[date to be announced]