Websitebit.ly/3tzOA9H

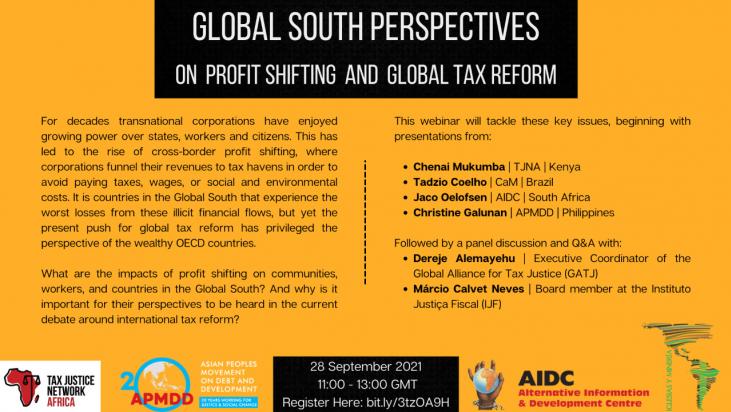

For decades, transnational corporations have enjoyed growing power over States, workers and citizens. This has led to the rise of cross-border profit shifting, where corporations funnel their revenues to tax havens in order to avoid paying taxes, wages, or social and environmental costs. It is countries in the Global South that experience the worst losses from these illicit financial flows, but yet the present push for global tax reform has privileged the perspective of the wealthy OECD countries.

What are the impacts of profit shifting on communities, workers, and countries in the Global South? And why is it important for their perspectives to be heard in the current debate around international tax reform?

This webinar will tackle these key issues, beginning with presentations from:

- Chenai Mukumba (TJNA / Kenya)

- Tadzio Coelho (CaM / Brazil)

- Jaco Oelofsen (AIDC / South Africa)

- Christine Galunan (APMDD / Philippines)

Followed by a panel discussion and Q&A with:

- Dereje Alemayehu (GATJ)

- Márcio Calvet Never (IJF)

Global South perspectives on profit shifting and global tax reform

Date: Tuesday, 28 September 2021

Time: 11 am – 1 pm (GMT)

Registration: bit.ly/3tzOA9H