Civil society views on the third session of negotiations for a UN Tax Convention.

From November 10th to the 19th, the third session of negotiations for a UN Framework Convention on International Tax Cooperation (UN Tax Convention) is taking place in Nairobi, Kenya.

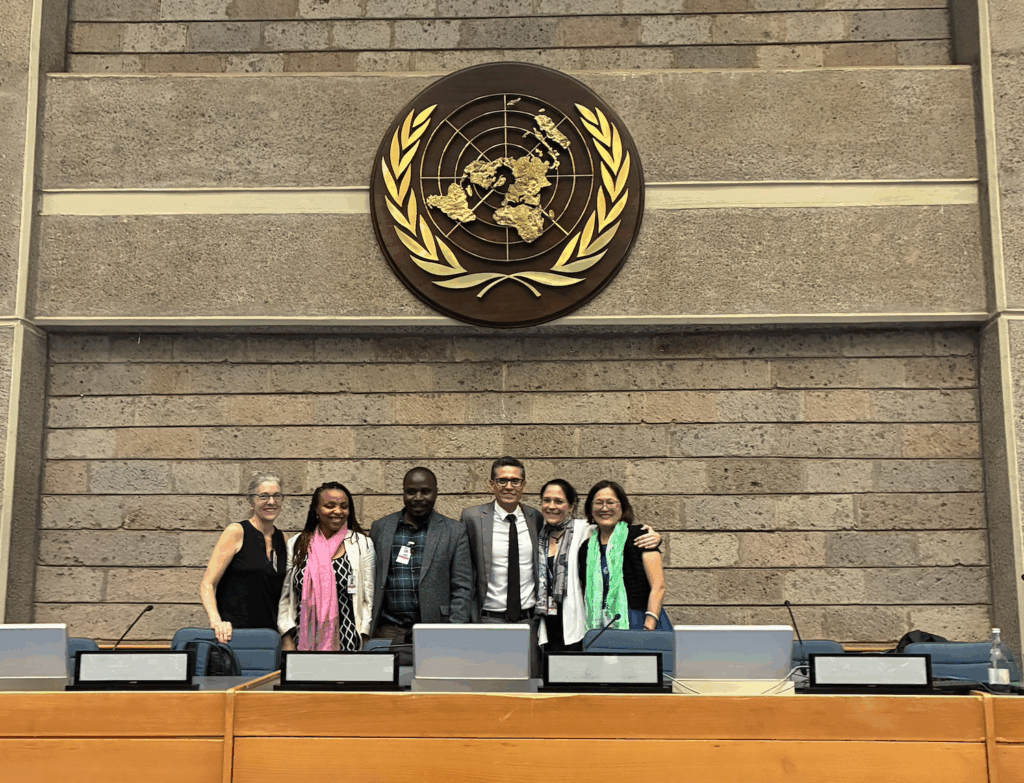

In the first week of negotiations for the legally-binding global tax treaty, civil society held a side event “Civil Society Proposals for Articles of the UN Tax Convention.” The side event, coordinated by the Global Alliance for Tax Justice (GATJ) and the Civil Society Financing for Development (CS FfD) Mechanism, highlighted the views of civil society and trade unions. With over 100 members attending the negotiations, and more following from afar, civil society continues to actively engage into the negotiations.

The Need for a UN Tax Convention

Opening the event, Luis Moreno, Chair of GATJ and member of Red de Justicia Fiscal de América Latina y el Caribe (RJFALC) shared: “We are here as civil society to discuss the UN Framework Convention on International Tax Cooperation which has the potential to deliver urgently needed resources for our countries.”

Tove Maria Ryding, Tax Justice Manager at Eurodad, expanded upon this: “We are calling this a trillion dollar treaty because this is a treaty that can restore the tax systems at the national level and help governments to find money.”

For over a decade, civil society has advocated for a UN Tax Convention to address the fundamental flaws of the international tax system. From now until mid-2027, countries are negotiating the Framework Convention and two early protocols, on taxation of services and dispute prevention and resolution.

Ryding highlighted the problems of the current global tax system: “Everyone is tired of the present chaotic tax system where the rules are unclear. Bringing clarity to this system is good for everyone.” She went on to explain: “We also want progressivity, the principle that if you have more money you pay a higher share. It’s not fair that currently the poorest people get taxes hard and the richest get taxed very little.”

Civil Society in the Negotiations

In the first week of the negotiations, delegates discussed the text of the commitments under the framework convention based on the Co-Lead’s Draft Framework Convention. In response to this draft released on October 24th, a broad coalition of civil society and trade unions coordinated by GATJ and its member Eurodad shared a joint response. Now, governments and stakeholders are invited to make submissions until December 5th.

Jeannie Manipon, Co-Coordinator of Tax and Fiscal Justice Asia (TAFJA) shared: “The UN Tax Convention will be a long fight. I am optimistic, we have excellent substantive inputs that we have prepared. We have a diverse global movement coming together here at the negotiations in Nairobi and around the world with experts from climate to the feminist movement.”

Civil society experts attending the negotiations work on issues including taxation, international cooperation, gender equality, development and climate action.

An International Tax System for Sustainable Development

The third session of UN Tax Convention negotiations takes place in parallel to the COP30 climate negotiations in Belém, where countries are looking for public finance to fund such climate action and sustainable development. The UN General Assembly has given the mandate for these negotiations to “establish an international tax system for sustainable development.” This includes advancing the three pillars of sustainable development: social, environmental, and economic.

Manipon highlighted key elements for the framework convention to include to: promote progressive taxation, reduce inequality within and between countries, include environmental protection, advance racial and gender equality, and finance quality universal public services.

Creating Fair and Effective Global Tax Rules

The first week of negotiations discussed the commitments on the framework convention. Panelists spoke about what needs to be included in the commitments of the framework convention.

Speaking upon the fair allocation of taxing rights, Everlyn Muendo, Senior Tax Policy Lead at Tax Justice Network Africa (TJNA) commented: “The global tax rules, especially the allocation of taxing rights, were not developed by us as Global South countries, nor for us. We need a fair allocation of taxing rights through implementing unitary taxation with formulary apportionment.”

On the effective taxation of high-net worth individuals, Africa Kiiza, Economic Justice Advisor at Christian Aid, intervened: “We need to effectively tax the rich and this includes through strong transparency measures. The excessive wealth of the super-rich is deeply rooted in unjust colonial structures.”

Panelists highlighted the importance for transparency measures including public country by country reporting, beneficial ownership, and automatic exchange of information. Liz Nelson, Director of Advocacy and Research at Tax Justice Network shared: “The world loses hundreds of billions of dollars annually. States least responsible for setting international tax rules bear the heaviest proportional cost. Transparency measures including public country by country reporting would be a significant deterrent to tax abuse.”

Panelists highlighted the urgency of the problem, as everyday that passes countries continue to lose urgently needed resources that could have been used to fund sustainable development.

What is Needed

Following this third session, countries will continue negotiations for a UN Tax Convention. Now, countries must increase the heat and bring real ambition and substantive content to the process: it is time to negotiate global tax rules that work for people and the planet.