Lea este artículo en español

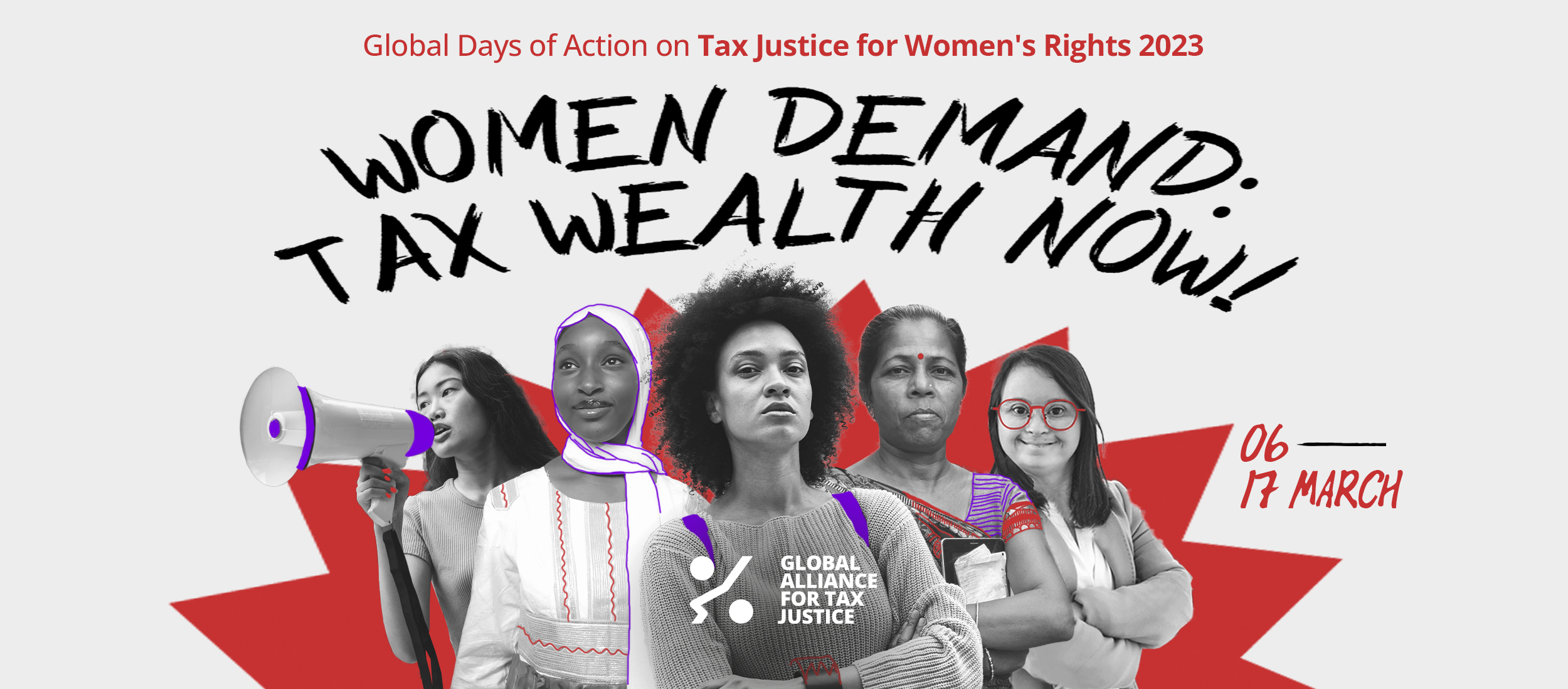

From 6 to 17 March, the Global Alliance for Tax Justice (GATJ), its regional networks – Tax and Fiscal Justice Asia (TAFJA), Tax Justice Network Africa (TJNA), Red de Justicia Fiscal de América Latina y el Caribe (RJFALC), Tax Justice-Europe (TJ-E), FACT Coalition and Canadians for Tax Fairness – and Tax and Gender Working Group (TGWG) will hold a unified campaign bringing together the tax justice and gender justice movements to call on governments and multilateral institutions to make taxes work for women.

The 7th edition of the Global Days of Action on Tax Justice for Women’s Rights is a concerted effort to increase visibility of tax issues affecting women worldwide. This year, the campaign will focus on the call for the urgent adoption of wealth taxes to advance towards the realisation of women’s rights, gender equality, and the empowerment of women and girls.

The rise in billionaire fortunes and poverty in a scenario of multiple and intersecting crises is indicative that, in the prevailing economic system, tax policies are failing in their essential role to redistribute wealth, promote equity and mobilise public finance to promote social wellbeing. Across the world, it is women who disproportionately bear the brunt. As of 2020, 252 men held as much wealth as 1 billion women and girls in Africa and Latin America and the Caribbean.

“The campaign highlights the urgency in rethinking structural and policy-level taxation issues as part of the demands for women’s rights. The special focus given to wealth taxes this year aims to underscore that curbing wealth concentration and absconding is paramount to address intersecting gender inequalities and promote the full spectrum of women’s rights,” explained Âurea Mouzinho, global policy and campaigns coordinator at GATJ, and co-chair of the TGWG.

“In the time of a compounding crisis accompanied by a disruptive and unequal global economic system, there’s no alternative to wealth tax on ensuring women’s rights,” said Ommey Nahida, senior policy specialist for economic justice at Christian Aid and co-chair of the working group. “Demanding wealth tax is now or never!”

“When designing tax policies, governments ought to take into account that women are a non-homogeneous group. The use of an intersectional lens in tax administration, coupled with active participation of women in the policy-making processes, is key for the achievement of tax justice for women’s rights,” highlighted Grace Namubange, financing for development and tax justice program officer at Seatini Uganda, also co-chair of the GATJ’s TGWG.

Throughout the two weeks of the campaign, GATJ, its regional networks and partner organisations will engage in virtual, in-person and hybrid events and activities. “With about 30 activities planned for the two weeks, I hope these global days of action will open space for critical debates, sharing experiences and also building solidarity towards a strengthened feminist tax justice advocacy”, concluded Mouzinho.

Check out the full programme

About the GATJ’ Tax and Gender Working Group

Established in 2016, the TGWG is a space for the GATJ’s members and committed partners to engage directly in campaigns and policy work on tax and gender. It aims to strengthen the global integration of tax and gender justice movements, and has been broadening participation by working closely with women’s rights organisations, global trade unions, academics, non-governmental and civil society organisations. Currently co-chaired by GATJ, ChristianAid and Seatini Uganda, the working group co-organises with the alliance’s regional networks the annual campaign Tax Justice for Women’s Rights.