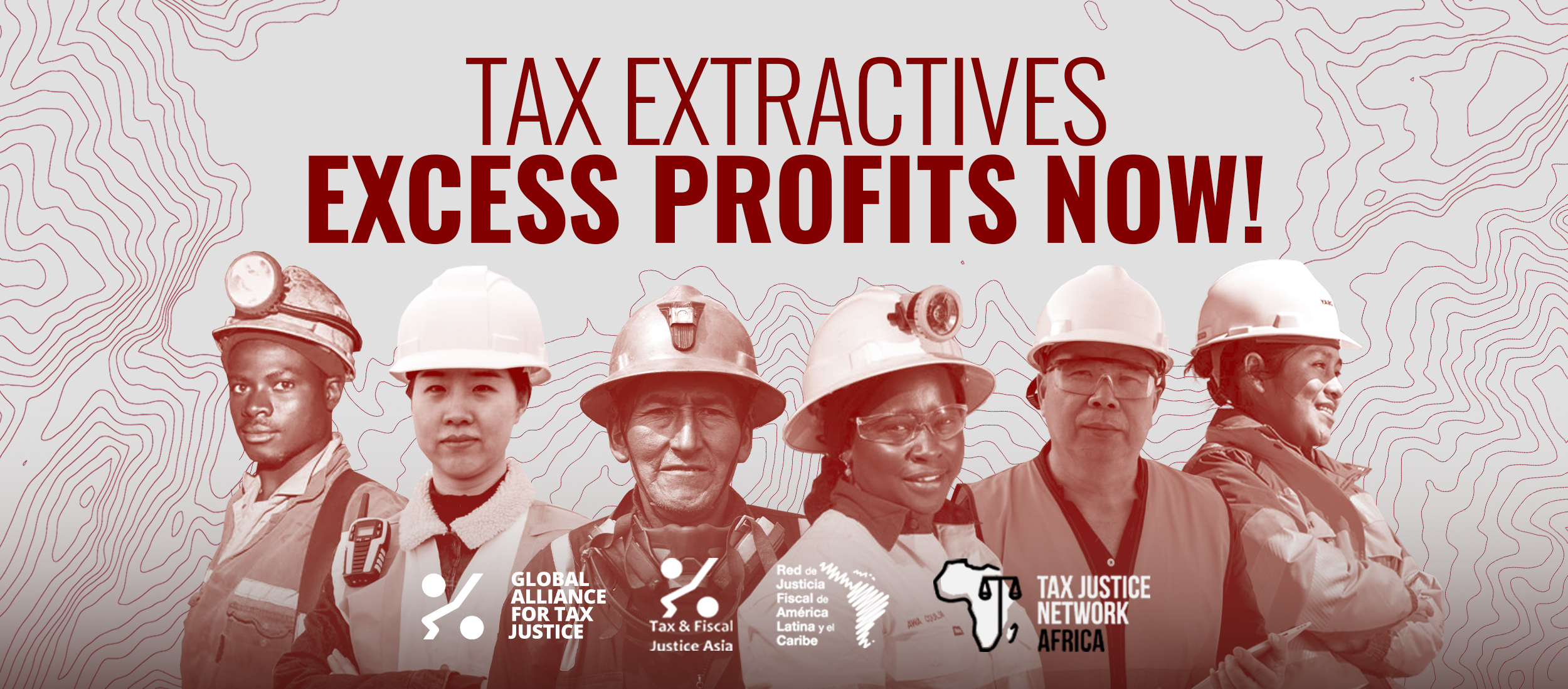

The Global Alliance for Tax Justice (GATJ) and its regional networks Tax and Fiscal Justice Asia (TAFJA), Tax Justice Network Africa (TJNA), and Red de Justicia Fiscal de América Latina y Caribe (RJFALC) will host the Global Days of Action for Tax Justice in the Extractive Industry from 21 to 25 November 2022. The 4th edition of the campaign builds on the demands that the GATJ members have been pushing for since 2019, and calls more specifically for excess profits taxes on oil, mining and gas companies.

The continuing impacts of the global pandemic and the climate crisis have spawned a glaring gap between a tiny set of winners and the majority of the world’s population. In 2022, net profits of the 40 largest mining corporations grew by 127% from the previous year, surpassing their pre-pandemic revenues by more than double. However, few people benefited from the boom: research shows that there was a 130% rise in dividend payments and rewards for top executives, whereas many lost their homes, incomes and livelihoods.

Reports by the International Consortium of Investigative Journalists (ICIJ) expose that mining corporations systematically shift profits and wealth through corporate manoeuvring and shell companies registered in low-tax jurisdictions. On top of these illicit financial flows, they reveal the extent of regulatory capture by mining interests, involving patronage and corruption in processes of securing mining licences.

Social movements, particularly in climate, labour and gender justice, have been raising proposals for the extractive sector to operate responsibly with communities and the environment. Building connections with these demands, this campaign brings the perspectives of tax justice and the broader economic justice movement, calling for a rights-based economy that puts people and the planet at the centre of discussions and decision-making.

“The global crises make closing tax loopholes and raising more public revenues more urgent and imperative. However, the extractive sector continues to be given free rein to extract resources and profits with neither limits nor regard for social and economic costs or for irreversible environmental impacts,” said Dereje Alemayehu, Executive Coordinator of GATJ. “In addition to the profit shifting and illicit financial flows rampant in this sector, facilitated by the broken global tax governance and lack of regulatory and transparency mechanisms, the extra profits being generated by those benefiting from the crises remains untaxed. It is high time to take urgent and rigorous measures in the extractives sector to raise more revenue: stopping the perverse flow of resources from low-income to rich-OECD countries; scrapping tax giveaways, curbing loopholes and tax abuse, as well as immediately introducing tax on extra profits. An inclusive and equitable recovery will only be possible through tax justice.”

Read the campaign’s concept note.

Global tax justice calls

The global tax justice movement calls on governments and multilateral institutions to:

- Stop illicit financial flows and tax abuses in the extractives sector;

- Tax the superprofits of extractives corporations by instituting windfall profit taxes;

- Curb tax incentives granted to the extractives industry;

- Make extractives companies pay their share in taxes and immediate costs of rehabilitation and rebuilding;

- Use taxes for peoples’ needs, especially for the needs of communities affected by social and environmental damage; and

- Protect and uphold the rights of workers and women affected by mining, including their rights to defend their communities.

Programme

18 NOV | 11 am Pretoria

Online event: Resource Backed Loans and Collateralization of Mineral Resources

Organisers: Afrodad and Tax Justice Network Africa

The webinar seeks to pinpoint Africa’s over reliance on mineral resources as the primary commodity export. This overdependence on mineral resources could be a result of IMF’s fiscal consolidation country advice on debt management and how resource-rich countries that are in debt distress are forced to resort to RBLs as a way of financing their debt. Through this online discussion, we seek to analyse whether resource backed loans and collateralisation of mineral resources are a sustainable financing option for African countries and showcase how the current multilateral and international financial system contributes to a vicious cycle of dependence on RBLs.

Registrations: bit.ly/GDOA-tax-extractives-2

21 NOV | 2 pm Central European time

Launch event: Tax extractives excess profits NOW!

Organisers: Global Alliance for Tax Justice, Tax and Fiscal Justice Asia, Tax Justice Network Africa, Red de Justicia Fiscal de América Latina y el Caribe

The Global Alliance for Tax Justice (GATJ) and its regional networks kick off the Global Days of Action for Tax Justice in the Extractive Industry 2022 with an online round table, in which panellists from Asia, Africa, Latin America, Europe and North America will discuss the main issues each region has been facing with the extractives, as well as what could be achieved through tax justice and, more specifically, excess profits taxes in the sector.

Registrations: bit.ly/GDOA-tax-extractives-1

24 NOV | 1 pm Johannesburg time

Global South Perspectives on International Tax Reform: Report Launch and Discussion

Organisers: Alternative Information & Development Centre (AIDC), Asian People’s Movement on Debt and Development (APMDD), Churches and Mining Network (CaM)

In 2019, the three organisations began a collaborative project on issues related to illicit financial flows and base erosion and profit shifting. The objective is to facilitate action and grassroots advocacy to combat illicit financial flows and for tax justice, specifically within the context of developing economies with large extractive sectors. The most intensive area of work for the Global South Project has been to deepen research and advocacy specifically around the impacts of illicit financial flows and specifically profit shifting activities on a concrete, firm by firm and case-by-case level. However, this national work is fundamentally limited by the fact that these issues are tied to an international financial and tax architecture; architecture which will need to be addressed at the international level

Although initially hopeful at the prospect of real progress in international tax reform, the international tax justice movement has drawn attention to severe problems in the OECD-led reform process, including a bias towards Global North institutions and States. Crucially, a number of very concerning criticisms were raised about the content and mechanisms of the deal that is now being implemented. Now, as the OECD plan stalls in implementation and the calls for a UN-based alternative pick up momentum, a key priority is to firmly establish a unified assessment and critique of the OECD-led push that can help ground the discussions on alternatives from a Global South perspective; to move to a pragmatic discussion on the path forward. To this end, the three organisations have compiled an extensive research report titled Global South Perspectives on International Tax Reform. This report serves as an overview of the international tax reform process from the perspective of Global South countries with large extractive sectors, drawing on the recent explosion of original research conducted by Global South experts and activists on this topic.

Registrations: bit.ly/GDOA-tax-extractives-4

25 NOV | 4 pm Manila time

Unite and Fight! Tax Justice in Extractives Now: An Online Solidarity Gathering

Organisers: Tax and Fiscal Justice Asia, Asian Peoples’ Movement on Debt and Development, Women for Tax Justice

The gathering brings together voices of mining-affected communities and tax justice campaigners in the region, sharing stories of actions as we chart a way forward together. Singing to the tune of “Mining’s Price Tag,” we also invite everyone to join our photo action during the event.

Link to join the action: bit.ly/GDOA-tax-extractives-5

25 NOV | 10 am Johannesburg time

The state of mineral resource governance and tax justice in the SADC Region

Organisers: Southern African People Solidarity Network, Southern Africa Resource Watch, Stop the Bleeding Campaign

The Southern African Development Community (SADC) is the heart of mining in Africa, and the epicenter of illicit financial flows. Five out of the top ten emitters of IFFs are found in SADC – South Africa, the Democratic Republic of Congo (DRC), Angola, Botswana, and Zambia. With increased pressure to transit from fossil fuels to clean energy, SADC has significant reserves of the critical minerals – cobalt, lithium, manganese, graphite, nickel, and copper among others. Much as the future of mining looks bright from increased demand for critical minerals that are constrained in terms of supplies, the past shows that SADC, like the rest of Africa, has immensely struggled to harness mineral wealth for transformative development.

With more people being pushed into the extreme poverty bracket because of multiple crises – climate change, Covid-19, and escalating fuel and food costs due to the Russian-Ukrainian war –, SADC region faces a daunting task to make its critical mineral and critical condiment for transformative socio-economic development. This webinar seeks to highlight the state of natural resource governance, and its nexus to domestic resource mobilisation.

Registrations: bit.ly/GDOA-tax-extractives-3