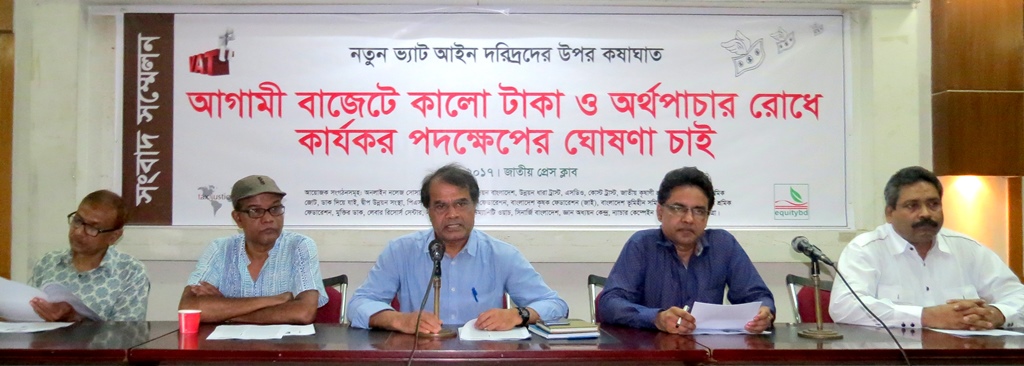

May 8th was the national budget preparation in Bangladesh, and on the same day 25 rights based civil society groups held a joint #TaxJustice press conference at the National Press Club, which they titled “VAT as Regressive to Poor : Announce Measures to Contain Black Money and Illicit Flow”.

“Government is embarking on this with IMF (International Monetary Fund) prescriptions, so there should not be emphasize on VAT, which is indirect tax, there should be more emphasize on direct tax, they opined”. They also “criticised the government as [they] found hardly any political will of government to arrest Blank Money and illicit financial flows, which are ever increasing. Civil society groups urged for an announcement in this regard from the government in next budget session”.

The press conference was moderated by Rezaul Karim Chowdhury from EquityBD, who introduced the panel affirming, “the government must stop the loopholes first to do local resource mobilization prior to embark on new law on tax mobilization”. Then Monowar Mostafa, from Development Synergy Institute said, “the State cannot ignore the principle of ability of payment of its citizen, VAT defeats this principle, which is against the sense of social democracy”. “The Bangladesh government hardly follows a democratic and inclusive process for preparation of budget and setting tax principles”, Asgar Ali Sabri from Action Aid Bangladesh added. Aminur Rasul Babul from Upokuliya NGO Jote included that “due to the new VAT law, poor families’ savings will be eroded and then the investment towards education and health will be hampered”. Badrul Alam of Bangladesh Krishok Federation finalized the panel explaining how “the majority of farmers will be the main economy losers due to the new VAT law”.

Ahsanul Karim Babor also presented civil society’s position paper, elaborating 13 recommendations in this regard, where major demands are inspired from Indian examples:

- asking annual bank statement from all dual citizens,

- initiatives to have tax and bank transparency agreement with different countries,

- all transaction which is more than $2000 must be through bank transfer and with TIN,

- publication of white papers of Bangladeshi’s in Malaysia 2nd Home Program,

- consideration of banning money note and bring them in bank account taking the examples from recent rupee 500 and 1000 note banning in India,

- publication of white papers and report on stock exchange debacle, plundering of money from public banks, and Bangladesh Bank money heist and all above

- shunning the path of confrontational politics and space to the free growth of democratic institutions, so that people and business man will feel sense of security and they will not try for illicit flow.

You can find the position paper here in Bangla, as well as many press reviews in English and Bangla on equitybd’s website.