Global Alliance for Tax Justice’s partner AWID (Association for Women’s Rights in Development) published a policy brief on Illicit Financial Flows (IFFs) and their disproportional gender impact, unveiling “the current legal and political frameworks that allow multinational corporations to benefit from tax abuse to the detriment of people and planet”.

Titled “Illicit Financial Flows: Why we should claim these resources for gender, economic and social justice”, it is available in English, French and Spanish, the report was written by Attiya Warris, from the University of Nairobi.

The policy brief explores “the basic concept of IFFs and their disproportional gender impact, in relation to the drain in developing countries of critical resources, for the advancement of women’s human rights, as well as the current legal and political frameworks that allow multinational corporations to benefit from tax abuse to the detriment of people and planet.

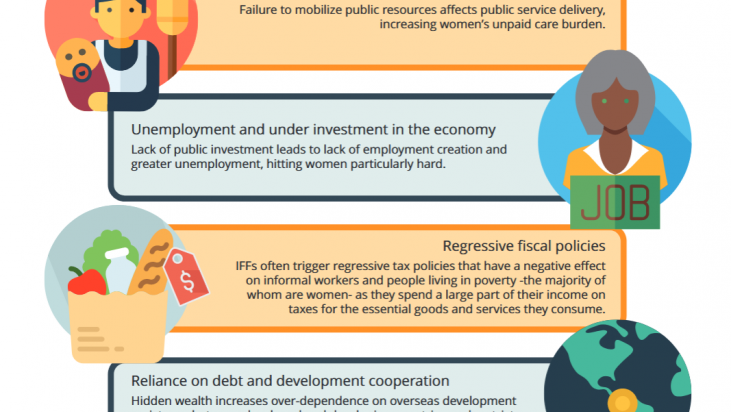

Among the disproportionate impacts of IFFs on gender justice, AWID lists:

- Impact on delivery of social services

- Unemployment and under-investment in the economy

- Regressive fiscal policies

- Principles of equality and non-discrimination

- Reliance on debt and development cooperation

- Threat to women’s peace and security

- Resourcing for women’s rights and gender justice

“This brief, introduces AWID, is an invitation to advocate for stricter financial regulation, and an end to corporate privileges that are detrimental to people and planet”.

It also offers initial policy recommendations to support feminist and gender justice organizations, as well as policy-makers, in influencing relevant decision-making spaces or to potentially complement and deepen the already existing engagement and positions:

You can follow the conversation through #TaxJustice and #ResistCorporatePower.