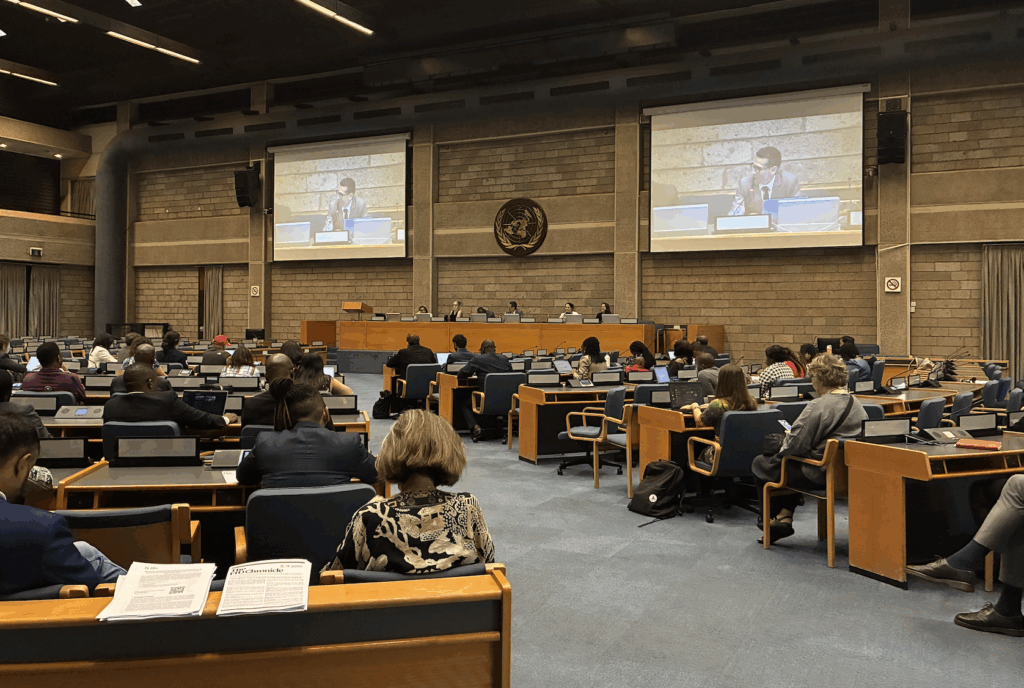

Civil society in the third session of negotiations for a UN Tax Convention.

From November 10th to the 19th, the third session of the intergovernmental Negotiating Committee (INC3) for a UN Framework Convention on International Tax Cooperation (UN Tax Convention) took place in Nairobi, Kenya. Throughout the Nairobi session, over 100 members of civil society from around the world stood united in the negotiations, coordinated as a collective under the GATJ UN Tax Convention Working Group. GATJ was represented in the negotiations by it’s Secretariat and regional members from Tax Justice Network Africa (TJNA), Tax and Fiscal Justice Asia (TAFJA), Red de Justicia Fiscal de América Latina y el Caribe (RJFALC), and Tax Justice Europe (TJ-E). Civil society, including experts on tax, international cooperation, development, gender, human rights, climate, public services and health, came with clear joint proposals on what these negotiations must deliver.

The session was a critical step in the creation of a fair and effective international tax system. Dr. Dereje Alemayehu, Executive Coordinator of the Global Alliance for Tax Justice (GATJ), shared: “This was the first time that the negotiations for the international tax rules were held in Africa. This session was historic not only for the location but because of the discussions: it was the start of the intergovernmental negotiations to negotiate new global tax rules that will create a tax system for sustainable development. Now, we are calling for ambition and substance to deliver on this opportunity.”

The Road to Nairobi

Ahead of the Nairobi session, GATJ and the Civil Society Financing for Development Mechanism hosted a prep meeting with over 100 civil society attendees.

From now until mid-2027, negotiations for a UN Tax Convention and two early protocols are taking place. As analyzed in GATJ’s latest brief, The Long Road to the UN Tax Convention, INC3 has been critical as the first real opportunity to begin substantive discussions on the text of the negotiations.

Civil Society in the Nairobi UN Tax Convention Negotiations

The first week of negotiations covered the commitments under the framework convention including: a fair allocation of taxing rights; high net-worth individuals; mutual administrative assistance; illicit financial flows, tax avoidance and tax evasion; harmful tax practices; sustainable development; and prevention and resolution of tax disputes. The week closed with a short presentation on the first early protocol, on taxation of cross-border services in a digitalized and globalized economy. The second week covered the second early protocol on tax dispute prevention and resolution.

Grace Arina from TJNA providing an intervention (left) and civil society’s FfD Chronicle (right).

Throughout the negotiations, civil society has continued to speak as a collective, coordinated by GATJ with its member Eurodad. In multiple interventions, civil society shared the importance of having an ambitious, robust framework convention with clear commitments that give a strong mandate to the future body, called the Conference of the Parties. These points were also reiterated in the daily newsletter given to negotiators, the FfD Chronicle.

Civil society side event during the UN Tax Convention negotiations.

Midweek, civil society held a joint side event, “Civil Society Proposals for Articles of the UN Tax Convention.” The side event, coordinated by GATJ and the Civil Society Financing for Development Mechanism, highlighted the shared views of civil society engaging in the negotiations, particularly calling for ambition.

Civil society on the Global Day of Action for Climate Justice (left) and Dr. Dereje Alemayehu from GATJ speaking at a COP30 hybrid event (right).

The UN Tax Convention negotiations had important links to the COP30 climate negotiations which took place during the same dates in Belém. At the start of the negotiations, GATJ and Eurodad released a report on how to make polluters pay and deliver hundreds of billions USD through a Proposal for a surtax on fossil fuel industries’ profits. During the negotiations, GATJ’s Executive Coordinator, Dr. Dereje Alemayehu, spoke at hybrid event linking to COP30 by APMDD, AIDC, and JnT, Tax Justice for a Just Transition: Challenging Corporate Power from COP30 in Belém to the UN Tax Convention in Nairobi. On the last day of both negotiations, civil society’s newsletters at COP30 and in the UN Tax Convention negotiations included shared messages linking Belém to Nairobi.

Civil society’s evening with the Global Tax Body.

At the close of the first week, civil society hosted an evening event with delegates and other stakeholders to continue meaningful dialogue outside of the negotiations.

What is Next

Now, governments and stakeholders are invited to make submissions until December 5th. This is a key moment for governments to bring the ambition so urgently needed for this process. From now until the next session of negotiations in February and beyond, a collective of civil society from around the world will continue campaigning and advocating for a robust UN Tax Convention to fix the outdated and broken global tax system.