Leer este articulo en español

This week’s GATJ members’ round-up: a new briefing on official development assistance, a call for wealth taxes in the #8for8 campaign, rising support for greater tax transparency and more. Check out all highlights:

Asia

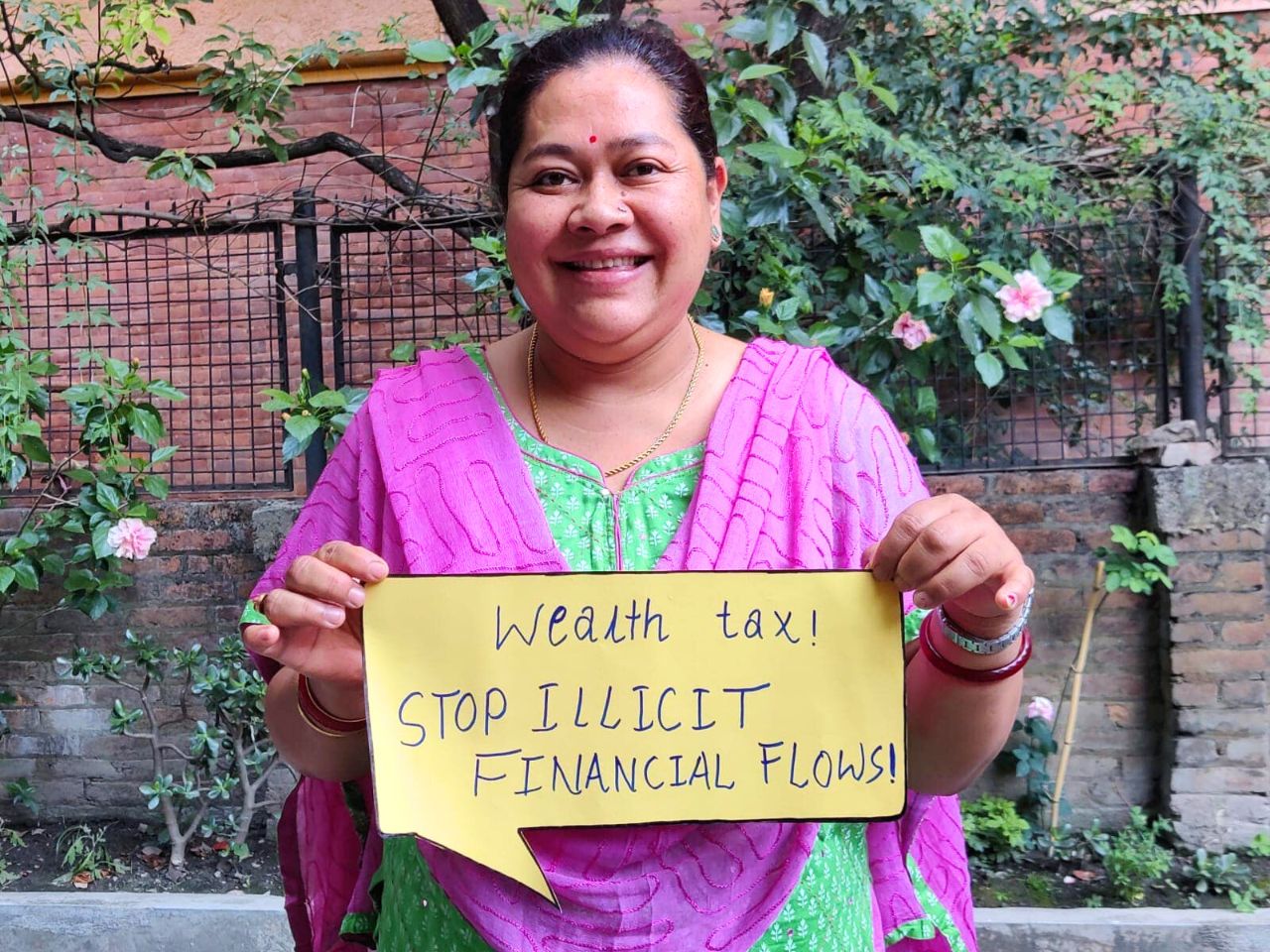

Tax and Fiscal Justice Asia (TAFJA) and the Asian Peoples’ Movement for Debt and Development (APMDD) called for wealth taxes in this month’s action, as part of the #8for8 campaign. As both highlighted, wealth taxes are key to help build economies that do not rely on debt and raise revenue to finance the urgent need for public services, especially in developing countries.

We reiterate our demand for “WEALTH TAX NOW!” and for justice and equality for women who represent two thirds of the poor in Asia and face discrimination in employment, education, and access to land and other resources.

– #8for8 with @lnacpil & @MVBuenaventura pic.twitter.com/0JG6lz7QhL— Tax and Fiscal Justice Asia (@WeAreTAFJA) June 9, 2023

Africa

Tax Justice Network Africa (TJNA) participated in two panels of the International Centre for Tax and Development (ICTD)’s Annual Lecture, conference organised with the Kenya Revenue Authority and the Kenya School of Revenue Administration. TJNA’s policy associate Everlyn Muendo explored Kenya’s trajectory in international tax, while acting executive director Chenai Mukumba spoke on what Africa has learned from a decade in multilateral negotiations..

Join the discussion this afternoon via https://t.co/8cDfcZIGTe

This panel will cover Kenya’s participation in regional and multilateral institutions, adoption of international tax instruments, successes and challenges in cross-border taxation and experience of the Digital… pic.twitter.com/ujVK8HzmhS

— Kenya Revenue Authority (@KRACorporate) June 5, 2023

TJNA announced they will be hosting a side event called “Leveraging Africa’s transition minerals for Optimal Domestic Revenue Mobilization” at the Extractive Industries Transparency Initiative (EITI) 2023 Global Conference, in collaboration with the Africa Center for Energy Policy (ACEP) and the African Forum and Network on Debt and Development (AFRODAD).

The session held at the event in Dakar (Senegal) aims to discuss strategies to optimise tax revenue collection from transition minerals by African governments. Learn more on TJNA’s website.

Latin America

Red de Justicia Fiscal de América Latina y el Caribe (RJFALC) participated in dialogues at the Argentinian Federal Administration of Public Income (AFIP)’s Workers Union to discuss ideas on the development of a tax platform to improve regional collaboration between countries in Latin America and the Caribbean.

📸 Algunas imágenes del diálogo sobre espacios de articulación globales y regionales por un #PactoFiscal realizado el miércoles 6/6 en @aefipc con la presencia de su Sec. Gral. @PabloFloresOk y su Sec. de Estudios Fiscales @RoberAlvarezOk y la participación de @AdrianFalco1 pic.twitter.com/TqojXybWdu

— Red de Justicia Fiscal ALC (@justiciafiscal) June 7, 2023

Europe

Eurodad released a briefing on official development assistance (ODA), with a deep analysis of OECD’s latest numbers. Authored by Nerea Craviotto, Eurodad’s Senior Policy and Advocacy Officer, Little to celebrate: An assessment of Official Development Assistance in 2022 shows that ODA reached an all-time high of US$ 204 billion last year, but explains how this seemingly positive number does not guarantee ODA’s integrity. Watch the recording of the launch event

Our 🆕briefing analyses the 2022 #ODA figures from @OECDdev ➡️ https://t.co/wTxisuyAMK

We found 15% of the reported US$204bn never left the donor country!

❎US$ 29.3bn for in-country refugee costs

❎US$ 1.5bn for excess #CovidVaccine donations

❎US$ 116m for net debt relief. pic.twitter.com/YlZmg6Svbh— Eurodad (@eurodad) June 8, 2023

North America

The Financial Accountability & Corporate Transparency (FACT) Coalition demonstrated how the tax transparency movement keeps growing in the United States. This time, the pressure from investors led shareholders to vote on resolutions calling for multinational giants like Exxon and Chevron to begin reporting tax and other data for each country where they operate. A similar resolution also had strong support in Amazon.

“It’s clear that investors are eager to see exactly where and how their portfolio companies are doing business, and whether those companies are earning their profits through innovation and competitive advantage, or risky and irresponsible tax practices,” said Ian Gary, executive director of FACT Coalition and member of GATJ’s coordination committee.

Other companies are going through the same process, FACT shows. See the full story on their website.

Major U.S. multinationals are facing a flurry of shareholder resolutions calling for #tax #transparency.

"These votes represent just one wave in a swelling ocean of support for greater tax transparency." – FACT's @Ianpgary https://t.co/rwMf49Fzza

— FACT Coalition (@FACTCoalition) June 2, 2023

Canadians for Tax Fairness (C4TF) shared an article by their economist DT Cochrane commenting on a tax reform proposal in the state of Alberta that includes tax cuts for corporations. “A growing body of economic research shows that tax cuts for big corporations don’t create jobs or investment – instead costing governments billions in lost revenue,” stated Cochrane in the article originally published by the Calgary Herald.

The network highlighted once again their ongoing petitions that call for wealth tax in Canada, excess profit tax, stronger tax laws for corporations and greater tax transparency. Check them out on C4TF’s website.

Canada *can* afford to invest in an equitable society, a stronger economy, & a more sustainable planet. If you agree, tell the government to take action: https://t.co/Cy2hS4Uj3V #cdnpoli #TaxTheRich #climatechange pic.twitter.com/acjiCPWzPT

— Canadians for Tax Fairness (@FairTaxCanada) June 5, 2023

Photo: APMDD Nepal