As we close this year, I am proud of how our movement has risen to meet this historic moment with the start of the negotiations for a UN Framework Convention on International Tax Cooperation. Throughout 2025, the Global Alliance for Tax Justice and our members worked tirelessly to ensure that civil society’s voice shaped these debates, underscoring that the ambition and purpose of the UN Tax Convention must be to fix the broken international tax system, ultimately creating global tax rules that work for people and the planet. As negotiations resume in 2026, we know the road ahead will demand even deeper collaboration, and I am confident that together we will continue the struggle to build a fairer and more just international tax system.

– Dr. Dereje Alemayehu, Executive Coordinator of the Global Alliance for Tax Justice (GATJ)

The UN Tax Convention Negotiations

Civil society in the Nairobi UN Tax Convention negotiations.

2025 was a historic year for global tax justice. This year, the negotiations for the new legally-binding global tax rules began and will continue until mid-2027. The UN Framework Convention on International Tax Cooperation (UN Tax Convention) is a once-in-a-century opportunity to create a fair and effective international tax system for sustainable development. It has the potential to deliver urgently needed sustainable finance to fund quality public services, development, human rights, gender equality, and climate action. Read GATJ’s latest publication on The Long Road to the UN Framework Convention on International Tax Cooperation.

Throughout the first year of negotiations, GATJ has continued to bring together a diverse movement of tax justice advocates to act as a collective voice both inside and outside of the negotiations. Following the November third session of negotiations in Nairobi, GATJ and over 190 civil society organizations and trade unions made a joint submission on the importance of ambition and substance in the UN Tax Convention negotiations. In recognition of GATJ’s leadership in this work, Luis Moreno, Chair of GATJ, was named as one of the top 50 people globally in tax for the second year in a row.

GATJ’s Secretariat and regional member networks repeatedly underscored the importance of these negotiations. At the UN Economic and Social Council Special Meeting on International Cooperation in Tax Matters, GATJ members shared multiple interventions on the importance of the need to rectify the broken international tax system.

In 2025, the link between financing for development and international tax cooperation was made even more clear. GATJ’s Secretariat and members took part in the 4th Financing for Development (FfD) Conference in Sevilla providing interventions and hosting side events. Ahead of FfD4, GATJ united with advocates on gender, human rights, development, and climate on the need to reform the international financial architecture under the Global Days of Action on Finance. In a publication, From Monterrey to Sevilla: International Tax Cooperation in the Financing for Development Conferences, GATJ traced the evolution of the FfD process, from the 2002 FfD1 in Monterrey to present-day FfD4 in Sevilla, as well as the origins of the call for a UN Framework Convention on International Tax Cooperation.

In 2026, the UN Tax Convention negotiations will resume in New York in February. GATJ looks forward to continuing uniting civil society to demand an ambitious and robust UN Tax Convention.

Gender-Transformative Tax Systems

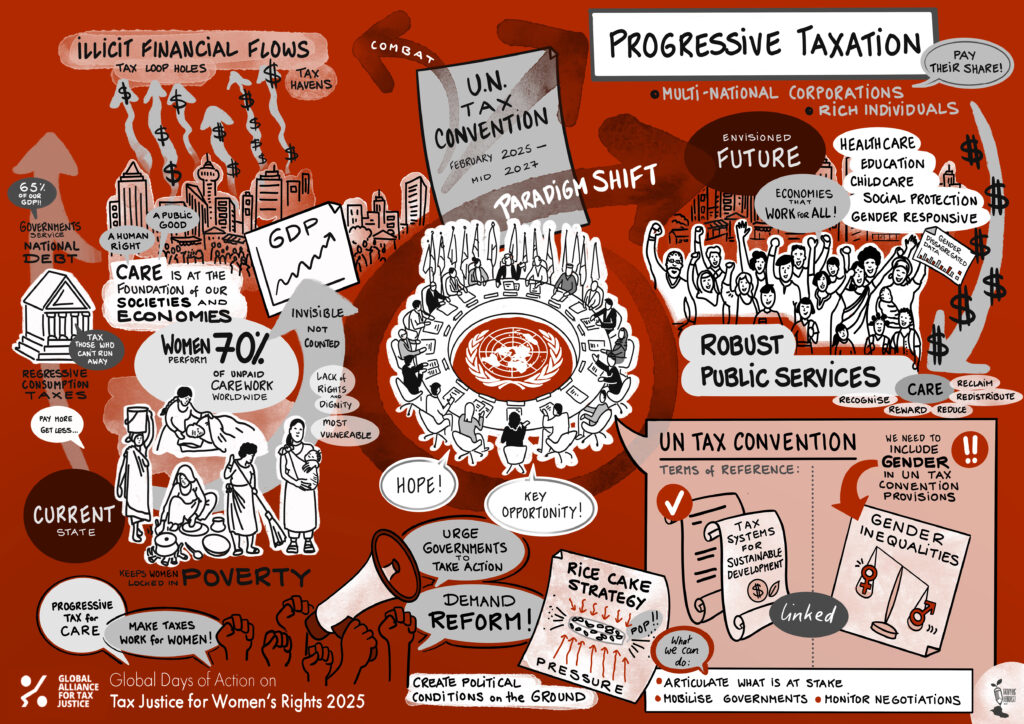

A visual summary of the 2025 Global Days of Action on Tax Justice for Women’s Rights.

Throughout the year, GATJ’s Tax and Gender Working Group continued to lead the fight for gender-transformative tax systems. GATJ highlighted the need for tax reform to improve care systems.

In March, the annual Global Days of Action on Tax Justice for Women’s Rights brought together feminists and tax justice advocates from around the world under the theme “Progressive Taxation for an Inclusive and Just Social Organisation of Care!” Throughout the campaign, GATJ alongside its members and allies held events on topics ranging from a gender-transformative UN Tax Convention to financing care systems. Organizers also held an event on the significance of the year as the 30th anniversary of the Beijing Declaration.

In June, GATJ’s Tax and Gender Working Group continued advancing feminist taxation, hosting a side event on rethinking care systems at the 33rd Annual International Association of Feminist Economics (IAFFE) Conference.

Make Polluters Pay

Civil society at an action during the Global Day of Action for Climate Justice.

Throughout the year, the tax justice and climate justice movements came together to demand that governments make polluters pay.

The November session of the UN Tax Convention negotiations took place in parallel to the COP30 climate negotiations. Climate negotiators in Belém highlighted the need for finance while tax negotiators in Nairobi discussed a convention that can deliver billions. GATJ Secretariat and members repeatedly spoke about the importance of bringing together these two processes to make polluters pay while delivering urgently needed finance for climate action and the just transition.

At the start of COP30 and the November UN Tax Convention negotiation, GATJ and Eurodad launched a report, Make polluters pay: Proposal for a surtax on fossil fuel industries’ profits. The report shows how taxing fossil fuel companies can catalyze the just transition and mobilize hundreds of billions of dollars for climate action.

Members of GATJ

Africa

GATJ Executive Coordinator speaking at the PAC Decolonizing the Global Tax Architecture panel.

Tax Justice Network Africa (TJNA) held the 10th continental conference of the African Parliamentary Network on Illicit Financial Flows and Taxation in Johannesburg where African legislators shared their commitment to combating illicit financial flows and advancing tax justice. The Pan-African Conference on Illicit Financial Flows and Taxation (PAC) marked the 10 year anniversary of the High Level Panel Report on Illicit Financial Flows from Africa. TJNA also continued important work on gender-responsive tax reforms as well as launched the Anti–Illicit Financial Flows Policy Tracker.

Asia

GATJ Executive Coordinator and TAFJA Co-Coordinator speaking about the UN Tax Convention negotiations.

Tax and Fiscal Justice Asia (TAFJA) and GATJ held a seminar on the UN Tax Convention in Kathmandu in May. The seminar analyzed what is at stake in a UN Tax Convention, the role of Asian civil society, and the relevance of the process for national and regional campaigns. TAFJA continued to have roundtables and internal discussion on the UN Tax Convention negotiations. At the Sagarmatha People’s Assembly: Voices from the Global South, TAFJA Co-Coordinators and GATJ Executive Coordinator spoke about the importance of linking tax justice and climate justice.

Latin America and the Caribbean

RJFALC members at the 37th ECLAC Regional Seminar on Tax Policy.

Red de Justicia Fiscal de América Latina y el Caribe (RJFALC) continued engaging in the Regional Platform for Tax Cooperation for Latin America and the Caribbean (PTLAC), welcoming the Brazilian presidency. RJFALC released a study on Tax Justice for Education. RJFALC also supported the 14th Regional Meeting on International Taxation, bringing together tax administrations, intergovernmental organizations, experts and civil society in Bogotá. RJFALC took part throughout the FfD4 process and the UN Tax Convention negotiations. GATJ and RJFALC also released a Frequently Asked Questions on the UN Tax Convention.

Europe

Tax Justice Europe (TJ-E) held a meeting with members in Paris. The meeting included sessions on updates from members on national tax policies in Europe, discussions on taxation at the EU, and advocacy towards European countries in the UN Tax Convention negotiations.

North America

The FACT Coalition launched a report on the fossil fuel industry: America-Last and Planet-Last: How U.S. Tax Policy Subsidizes Oil and Gas Extraction Abroad. FACT also shared an important op-ed during COP30 on how “Tax transparency can fuel the fight against climate change.”

Canadians for Tax Fairness (C4TF) launched three crucial reports this year: The rise and rise of tax havens: How the ultra-rich and mega-corporations hide wealth and cost us billions; Canada’s affordability divide: How the 1%’s rise left millions behind; and Exporting Profits: Alberta oil and gas workers fall behind while American shareholders thrive.