The Centre for Budget and Governance Accountability (CBGA) just published a new paper titled Foreign Direct Investment in India and Role of Tax Havens.

CBGA, a member of Tax and Fiscal Justice Asia, works at “enhancing transparency and accountability in governance through rigorous analysis of policies and budgets, and fostering people’s participation in public policy processes by demystifying them” since 2002. Each year, the Center and its specialists scrutinize and challenge the national budget and each state of the country, a work you can see in their “Union Budget Explorer dashboard” and in the videos filmed during the last Panel Discussion on Union Budget, titled ‘Of Hits and Misses‘, last February.

This new paper analyzes Foreign Direct Investment inflows to India over a period of ten years, assesses their ownership and control, and the cases where Indian DTAAs with tax havens and secrecy jurisdictions are being misused to route the FDI to India.

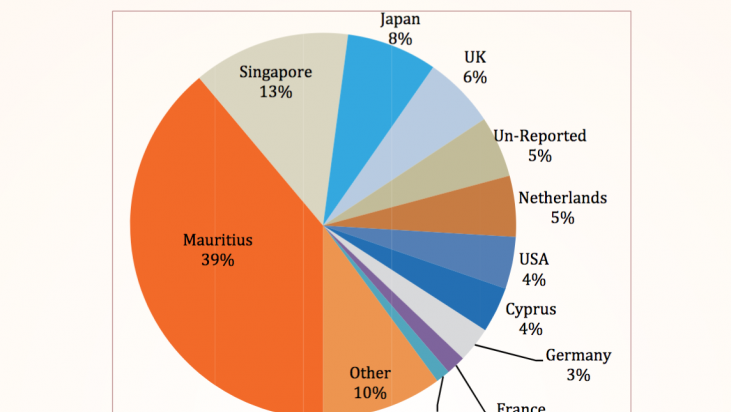

“Governments across the world, CBGA author Suraj Jaiswal explains, are trying to attract Foreign Direct Investment (FDI), as a policy tool to promote growth, employment, etc. India has also adopted policies for promoting FDI and has seen significant increase in FDI in the decade of 2000 and onwards. In this context, the paper looks at the FDI flows to India between 2004-14. It analyses where the FDI is coming from, especially countries who are regarded as tax havens such as Mauritius and Singapore and tries to explain the reasons behind it”.

“The paper makes use of a unique dataset which identifies the ultimate parent/controlling entity of the individual FDI inflows, and thus able to identify which FDI inflow is coming directly from the home country of investor and which are routed through the other country. To find the reasons behind the routing of FDI through a third country, it analyses the secrecy aspect as well as the tax agreement of that country with India to find the linkages between secrecy, tax agreements and routing of FDI to India”.