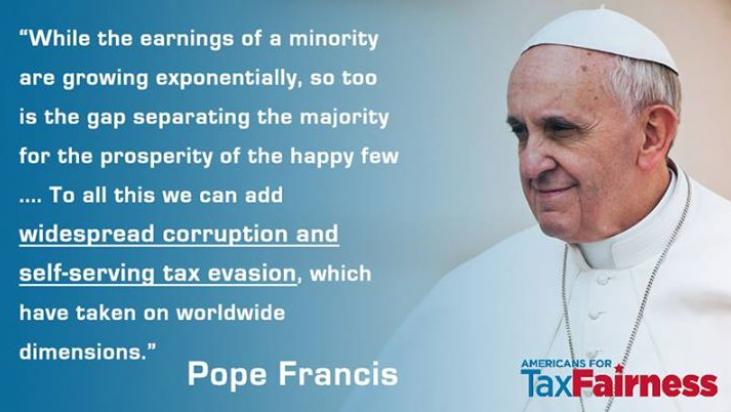

“… self-serving tax evasion, … the thirst for power and possessions knows no limits.”Pope Francis, Nov. 23, 2013

On the brink of another government shutdown, in the heat of a divisive presidential campaign, it is refreshing to see Washington come together to welcome Pope Francis. “His social teachings, rooted in ‘the joy of the gospel,’ have prompted careful reflection and vigorous dialogue among people of all ideologies and religious views in the United States and throughout a rapidly changing world, particularly among those who champion human dignity, freedom, and social justice,” House Speaker John Boehner said in inviting the pope to address Congress.

And Pope Francis is coming with a lot to teach. He has been outspoken on many of the most important issues facing our country and the world: the challenge of climate change, the demand for immigration reform and to accept refugees, and even the nuclear agreement with Iran.

Above all other issues, however, income inequality has been Jorge Mario Bergoglio’s main focus since he first became a Jesuit priest in the slums of Buenos Aires decades ago. In Evangelii Gaudium the first major work authored as Pope Francis, he wrote:

“While the earnings of a minority are growing exponentially, so too is the gap separating the majority from the prosperity enjoyed by the happy few. …

“Inequality eventually engenders a violence which recourse to arms cannot and never will be able to resolve. …

“Inequality is the root of social ills. …

We can no longer trust in the unseen forces and the invisible hand of the market. Growth in justice requires more than economic growth, while presupposing such growth: it requires decisions, programmes, mechanisms and processes specifically geared to a better distribution of income.

The pope’s visit comes at a point when income inequality has never been higher in the United States. Today, the top one-tenth of 1% of Americans own approximately the same level of wealth as the bottom 90% combined. Translation: America’s 161,000 richest families have more combined wealth than 145 million other American families.

Thankfully, there are many ways to address income inequality and expand economic opportunity in the richest country on Earth. We could raise workers’ wages and improve their benefits. We could give workers more bargaining power with employers by making it easier to join a union. And we could create a fairer tax system that raises sufficient revenue to fund vital services, provide benefits to those in need, and make new investments that create productive jobs and a more inclusive economy. As Pope Francis makes clear, it takes government resources to address inequality, and it takes a just tax policy to raise adequate government resources.

Unfortunately, the U.S. tax system rewards the wealthy and big corporations with loopholes and tax breaks that run counter to its admirable goals as a progressive tax system. For instance, many working families pay a higher tax rate on their salaries and wages than wealthy people pay on their investments. Instead of using the tax code to encourage American corporations to serve the greater good, they get billions of dollars in tax breaks for shipping jobs and hiding their profits offshore. That tax break alone is worth $90 billion a year. By comparison, itcosts $75 billion over 10 years to provide all low- and moderate-income four-year-olds with high-quality, publicly-funded preschool.

American corporations paid $1 out of every $3 of all tax revenue in the 1950’s, but today, corporate taxes make up less than $1 out of every $10 of all tax revenue. That means workers and small businesses are filling the gaps to pay more for public services like roads, schools and hospitals – despite the fact that American corporations are earning record profits. Ultimately, there is less money to invest in America.

As Pope Francis wrote in Evangelii Gaudium, “self-serving tax evasion, … the thirst for power and possessions knows no limits.” The U.S. tax code is a powerful tool to help level the playing field and reduce income inequality. Recent developments, however, show it could become much less fair than it is already. Recently the U.S. House of Representatives voted to abolish the estate tax, which only millionaires and billionaires have to pay. It is one of the best ways to limit financial dynasties that corrode our democracy. Estate tax repeal would give a $3 million average tax cut for the wealthiest 0.2 percent of households

At the same time, there has been no action in Congress to extend the Earned Income Tax Credit or Child Tax Credit, expiring items that provide a few thousand dollars in tax incentives to hard-working low-income families. Failing to save these credits could push 16 million Americans, including nearly 8 million children, into – or deeper into – poverty. Pope Francis would disapprove.”Working for a just distribution of the fruits of the earth and human labor is not mere philanthropy,” the pope said in Bolivia in July. “It is a moral obligation. For Christians, the responsibility is even greater: It is a commandment.”

After addressing Congress on Thursday, Pope Francis will leave Washington. Just as Republicans and Democrats came together to welcome him, our policymakers should work together to ensure the spirit of Pope Francis’ visit is reflected in their work once he is gone.

*Article written by Frank Clemente, Executive Director, Americans for Tax Fairness, in The Huffington Post